Capetonian Sam Laing sounds like a brand ambassador when she talks about her favourite local mobile payments application. But she isn't. Instead, she's one of a growing number of people in South Africa's Mother City who are leaving their wallets at home in favour of digital money apps.

Even street sellers of The Big Issue magazine can now accept payment by mobile in South Africa

"I use SnapScan," she says. "I love it. If I find someone using SnapScan I will buy something even if I wasn't intending to.

"I find myself telling small coffee shops and vendors at markets that they should get it. I love not needing cash on me. I love not handing over my credit card."

Fast payments

Views like these account for the arrival of a number of different mobile payments options. SnapScan has garnered the most attention, but the sector also includes the likes of FlickPay, Zapper and GustPay.

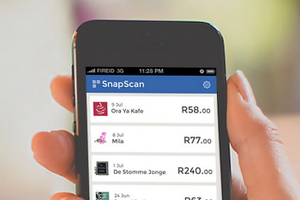

SnapScan merchants receive a static QR [quick response] code - or SnapCode - identifier to display next to their tills.

Customers register on the app and link their credit card, paying by scanning the code with their phones, and confirming the payment with a PIN or fingerprint. The merchant receives confirmation of the payment on their nominated phone.

"At its core, SnapScan is about giving everyone access to fast, convenient and safe electronic purchases," says co-founder Kobus Ehlers.

"We designed the product to suit a wide variety of shops, from the largest retailer to a small street vendor selling fruit next to the side of the road."

SnapScan has also partnered with the City of Cape Town to allow motorists to pay parking marshals in the city using the app. Each marshal is equipped with a unique QR code that motorists scan to pay for their parking.

And even Big Issue sellers can now accept SnapScan mobile payments.

FlickPay's system is the other way round, where the user "flicks to pay" by pushing a slider button on the app and entering a PIN, which generates the unique QR code. The retailer then scans this code with a QR reader installed on the till.

"It's all about ease and efficiency," says Zac Rusagara, head of commercials at FlickPay. "It is easing the process, and it is being on trend. It's cool."

Plastic not so fantastic

Cost is also a factor.

"We aim to drive down the cost of electronic transactions and displace cash payments in many places," says Mr Ehlers.

"SnapScan does not charge shoppers any fees. Merchants pay a small transaction fee that is comparable or cheaper than using normal credit card facilities."

FlickPay is also free for customers, while Mr Rusagara says his company works with retailers to agree a transaction price equal or less than that charged by a bank, known as its acquiring rate.

"We are not set on acquiring rate, we are much more flexible and able to come to a solution that works for both parties," he says.

This cheaper and more efficient way of making transactions seems to be appealing to customers and merchants alike, with both SnapScan and FlickPay now available nationwide.

Mr Ehlers says he is "very heartened" by SnapScan's growth, with approximately 14,000 merchants accepting payments using the service in South Africa, and thousands of users making payments each week.

Mr Rusagara would only say FlickPay has a "sizeable" market share.

South Africa certainly seems to have embraced mobile payments with enthusiasm - roughly half the population now owns a smartphone.

And one bank, FNB reports that its customers are making 230 million mobile payment transactions per month, compared to 45 million on the popular M-Pesa platform in Kenya.

Cashless then cardless

This growth potential has not gone unnoticed by global companies.

Apple rolled out its mobile payments service, Apple Pay, in September, enabling iPhone 6 users to buy goods using the phone's ID fingerprint recognition system.

SnapScan and FlickPay say they believe Apple's move into payments will benefit the ecosystem as a whole.

Mr Ehlers says SnapScan is not positioned as just another payment product, and feels that card systems and next-generation card systems such as Apple Pay will help a large sector of the retail market.

"SnapScan instead tries to give access to electronic payments to a large group of merchants who do not qualify for formal card payment facilities, or where card machines do not make sense," he says.

Mr Rusagara says: "It is not the first time people have been used to linking their credit cards to their phones. People like Apple have actually paved the way for us.

"Then people like Uber have come to the market. So people have become a lot more comfortable with the idea of linking their phones to their cards to make a transaction."

Independent corporate finance and financial technology consultant Theo Winter believes that Apple Pay's impact will be limited in South Africa.

"Apple Pay requires merchant PoS [point of sale] integration, so will take a while to roll out here," he says.

"We should also keep in mind that South African market dynamics are different to those of the US."

Security concerns?

One concern is over security. Rahul Jain, co-founder of secure payments solution Peach Payments, says credit card data is not adequately protected in the event of loss or theft of a mobile device. Regulation has yet to catch up, he believes.

"Regulation and guidelines around mobile transactions and data security are not as developed as those for web payments and services," says Mr Jain.

"So what you are seeing is that organisations such as the PCI Security Standards Council are increasingly treating these transactions separately, and then coming up with guidelines on how merchants and service providers can secure the card data on mobile devices and payment applications."

Mr Winter, however, feels security is actually enhanced by the likes of SnapScan and FlickPay, as the customer's credit card is never handled by the merchant so cannot be skimmed or copied.

Mr Rusagara says the system is secure for both customer and retailer, with QR codes expiring upon use, or after 90 seconds.

Security doubts aside, the growth of such solutions continues apace, and Mr Ehlers sees the potential for mobile payments to extend into other areas, such as the Cape Town parking payments option.

"We've seen a lot of interest from churches in the last few weeks, for instance, as the app allows for immediate, relatively large donations, while also eliminating the hassle of managing and administrating cash collections," he says.

"We hope to be able to continue offering this product to customers in a variety of settings, always making their lives a little easier."